Topics:

Marketing StrategySubscribe now and get the latest podcast releases delivered straight to your inbox.

“Inbound Marketing, eh? So, does it really work?”

“Inbound Marketing, eh? So, does it really work?”

This is the response I’ve received on more than one occasion when I’ve told people that I’m working with an Inbound Marketing agency.

If you’ve been a business owner - or if you’ve ever been responsible for business development in an organization, you likely have experience with spending money on services such as PR, Advertising, and Marketing that failed to deliver the results that you needed.

If you’re nodding in agreement, you are not alone. John Wanamaker, the famous 19th century merchant and marketing pioneer, once muttered “Half the money I spend on advertising is wasted; the trouble is I don't know which half.”

Traditional marketing agency thinking is to keep deliverables non-auditable.

The idea was that the more that you promised to deliver in things that couldn’t be directly measured (think brand recognition, awareness, reputation, and goodwill, etc), the easier it would be to defend your fees when your client’s business did not reach goals.

A Data Shift in the Marketing Paradigm

With the dramatic increase in access to data, this old paradigm is shifting.

More and more potential clients don’t (and won’t) care about what you are selling, until they feel that you truly understand their pain points and goals. They want to see a message that resonates with them and results that will help them achieve their goals.

Which Data is the Right Data?

There are many people who can probably help you understand the technical details of Inbound Marketing better than I can, so I’ll leave that to them, but when it comes to data, that’s where I reign supreme.

Inbound Marketing, unlike traditional outbound methods, has opened up a whole new universe of data, offering marketers the ability to track their activities, monitor their performance, and then adjust as needed.

But now that you’ve bought into inbound and have been collecting data -- what should you really be looking at?

As an organization, you need to determine which key performance indicators (KPIs) actually reflect success in your business model.

There are a number of metrics that can act as indicators of a successful program (i.e. Web Traffic, Conversion Rates, Bottom of Funnel Leads, and New Business Closed), but as every business model is different, you may find that some metrics are more relative to your situation than others.

For example, if your product is software designed to be used daily, Monthly Active Users would not really be as indicative of your current success as Daily Active Users.

When it comes to determining which data is the right data for your team to be monitoring and tracking, make sure that is relevant and honest, but you can learn more about that in this post when you get a chance.

The Importance of Return on Investment

Regardless of what your business does or makes, the one metric that brings everything together and proves the monetary effectiveness of your initiative is ROI (Return on Investment.)

Determining a project's viability via an ROI analysis is crucial for every organization because it focuses on the money you get in exchange for the money that you spend.

Having passion, dreams, and stretch goals are an important part of a successful business, but they are no match for data when it comes to making investment decisions. If an investment isn’t making you money, it’s most likely not a wise choice.

Calculating ROI only requires a few basic steps. Let me walk you through it:

1) Calculate incremental profit or cash flow.

Whether you look at profit or cash flow is up to you and your accountant, but either way, the benefits need to be projected and tracked over the time that the program is in effect.

Essentially, you need to answer the question “What is the financial benefit that I would not have realized without this project?”

2) Discount for time value of money.

Most projects are not completed immediately; rather they span an extended period of time. Although interest rates continue to hold at historically low levels, any project over 90 days should take into account the difference in value between a dollar today and a dollar in the future. This is an important financial reality -- whether we like it or not.

3) Compare to total cost.

The question to ask yourself here is “What is my total incremental cost?” Be sure to add extra labor, software, and other appropriate costs to your analysis. Conversely, if there are expenses or resources that you can reallocate, be sure to give yourself credit for those.

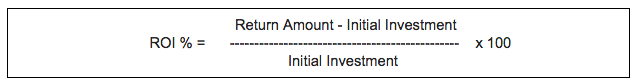

Once you have all of your costs, there are a number of tools available that you can use to input your numbers and analyze the results like this calculator from Governance Training. You can also calculate it by hand using the equation below:

With this in hand, the ideal way to use your ROI calculation is to compare it - either to other ROI calculations or to your standard (i.e. your business may choose to only invest in projects with a return of at least 20%.)

Key Takeaway

So, welcome to the brave new world of Inbound Marketing; where we have at our disposal the tools necessary to measure the effectiveness of segments of our business that used to be dominated by smoke and mirrors.

This is an exciting breakthrough and an opportunity for both marketing agencies and their clients to differentiate themselves from their peers via intelligent use of data and associated tools.

As you are building your ROI calculation, here a few things to keep in mind in order to maximize the effectiveness of this data:

> Focus on incremental changes.

Every financial metric, whether it involves money coming into or going out of the organization, should be measured incrementally, that is how much greater is the value with the program than without it. Baseline numbers should be excluded from any ROI analysis.

> Do not use revenue as your numerator.

This is a big one. You want to focus on profit, not revenue. Many people make the mistake of measuring returns in terms of revenue and neglect the cost to service the incremental revenue. This lead to ROIs calculations that are too high and not indicative of the real benefit of the system.

> Don’t forget that time is money.

As noted above in step 2, discount future cash flows (both in and out) to account for inflation. Something as basic as LIBOR is fine.

Free Assessment: