Subscribe now and get the latest podcast releases delivered straight to your inbox.

How to apply for $284 billion in new PPP funding — even if you received funds in 2020 (+ application)

By Bob Ruffolo

Jan 18, 2021

With a second stimulus package finally getting the green light from congress in December, more Paycheck Protection Program (PPP) funds will soon be available for SMBs across the country.

Just like last time, the PPP provides forgivable loans to qualifying small businesses who use what they receive to pay for things like payroll, rent, and utilities. As before, these funds will be distributed by SBA lenders and are entirely forgivable if used for approved operating expenses.

Congress has made $284.5 billion in PPP funds available, but this can go quickly and companies should apply as soon as possible. Just like in 2020, borrowers can receive loans covering up to 2.5 times their average monthly payroll costs.

Forgivable PPP loans are not just for businesses. Nonprofits, veterans organizations, self-employed individuals, sole proprietorships, independent contractors, veterans organizations, and tribal groups can apply, provided they meet certain criteria.

There are also funds set aside specifically for very small businesses (with 10 employees or fewer) as well as for minority, underserved, veteran, and woman-owned businesses, so every business should consider applying.

The portal to submit “first draw” applications opened on January 11th, so interested businesses should speak to their bankers and submit their materials as soon as possible.

🔎Related: SBA’s Frequently asked questions for borrowers and lenders

First draw PPP application

Starting on January 11th, businesses with fewer than 500 employees that did not receive Paycheck Protection Program funding through the 2020 CARES act can apply for relief under this new bill, for up to $10 million, using this application form.

The legislation earmarked more than $140 billion of PPP funding specifically for businesses that did not receive loans the first time around.

In addition to the form above, you will also need to submit payroll information, IRS form 941 (or an equivalent) and other financial information related to employee compensation (like evidence of retirement and health insurance contributions).

The U.S. Treasury requires that at least 60% of the PPP loan amount go to payroll expenses. The additional funds can be used for:

- Costs related to the continuation of group health care

- Mortgage interest payments (but not mortgage prepayments or principal payments)

- Rent and utility payments

- Interest payments on any other debt obligations that were incurred before February 15, 2020

- Refinancing certain SBA loans

- Other operating costs (ranging from damage from civil unrest to cloud computing expenses)

For businesses who have been adversely affected by the COVID pandemic and did not receive PPP funding the first time around, you should start the application process now.

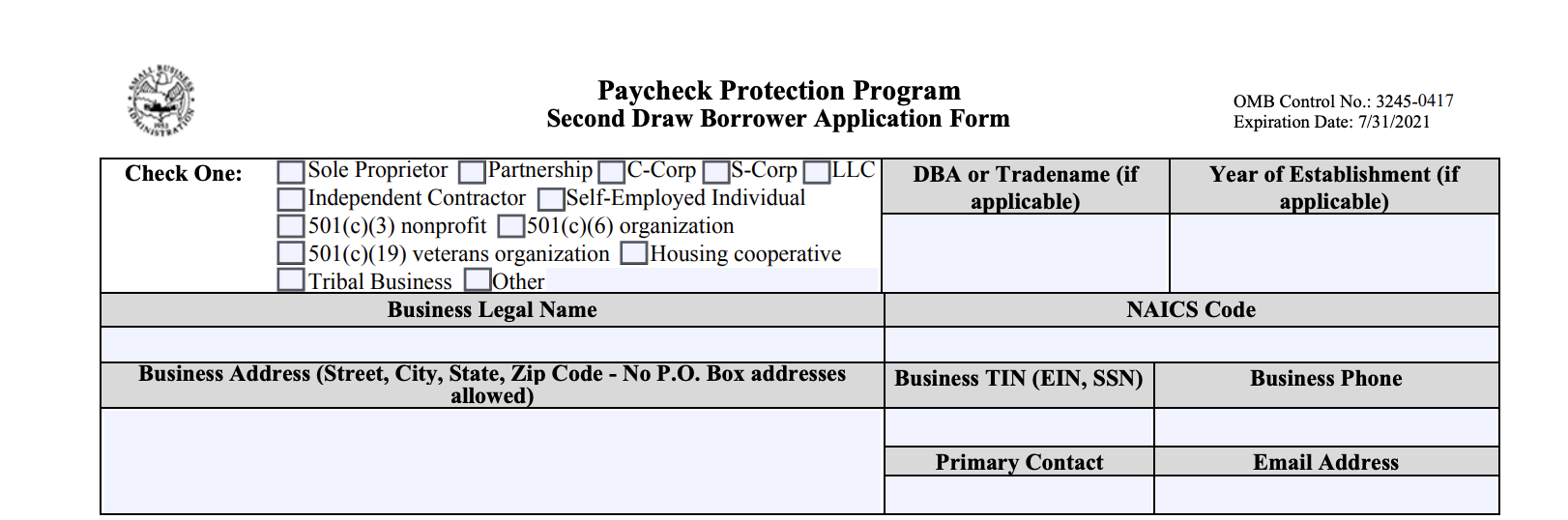

Second draw PPP application

Organizations that received PPP funds in 2020 can apply for additional funding this year, up to $2 million.

Roughly $137 billion has been set aside for businesses seeking a second PPP loan, and applications will be open to all applicants on January 19th.

Businesses can apply for a second round of PPP funding if they meet the following criteria:

- Have no more than 300 employees

- Have used (or will use) the full amount of their first PPP loan

- Can show a drop of at least 25% in annual gross receipts or for any quarter of 2020, compared with the same quarter in 2019

- Have not permanently closed (*Businesses that have temporarily closed can still receive a second-draw loan)

Second draw PPP applicants need to use this application form, as well as provide additional payroll and expense information as needed.

What’s different this time: Tax deductible status

Changing course from last spring, the newest COVID stimulus bill will allow qualified borrowers to deduct the payroll costs and other business expenses that were covered by forgivable loans.

Back in May, the federal government issued billions in relief funding to SMBs, but some tax details were confusing. However, officials have since clarified their stance. According to the SBA, the new funding act “provides for the full deductibility of ordinary and necessary business expenses that were paid with a forgiven or forgivable PPP loan.”

Give yourself the best chance to get funded

According to SBA data, 82% of lenders participating in PPP have less than $1 billion in assets. Therefore, some experts recommend working with local banks for a better chance at loan approval.

The surest way to get funding is to leverage the relationship you already have with your business banker. Make sure you have all necessary application materials prepared to be submitted as early as possible.

Then, after you submit them, check in with your banker to see the status of your application.

You are permitted to apply with multiple banks simultaneously, but you may not accept more than one PPP loan at once. If your application is approved at one lender, make sure you withdraw your other applications.

PPP in practice: A massive undertaking with millions of moving parts

According to the SBA’s report, 2020’s CARES Act had already seen 4.8 million PPP loans given out, totalling more than $521 billion. These came from more than 5000 different banks and other lending institutions and went to every state in the union, along with Puerto Rico, Guam, and American Samoa. Two thirds of these loans were for less than $50,000.

The recipients of these PPP loans represented the broadest swath of American business, from health care to mining to arts and entertainment to food service — and the funding saved millions of jobs.

While the second COVID stimulus is smaller in size, you can expect similar complexity this time around. But, if your business is still smarting from the terrible fallout of 2020, look to put together your application as soon as you can to capitalize on resources that can keep your business strong in these tough times.

Talk to your banker today to find out what you need to do make sure your application is at the top of the list.

Remember, times of great uncertainty can also be times of great innovation, and we’ve already seen daring and brilliant pivots from businesses who have leaned into the challenges we’re all feeling.

A forgivable PPP loan can help you stay afloat as you chart your course and prepare to move forward.

If you can get it, get it

The pandemic has offered up a never-ending stream of challenges for businesses across the country and around the world. And certainly, some sectors like travel, hospitality, and airlines have been hit harder than others.

Does that mean that all hope is lost? Should you not even bother taking the second round of PPP and just wait for things to get better? Absolutely not.

All around us are stories of innovation, showing how some of the hardest hit companies quickly pivoted and found ways to survive and thrive during this pandemic. If they can do it, why can’t you?

Here’s one such story that can inspire you.

Of all the industries upended by COVID, the travel sector has been one of the hardest hit. Boston-based Lola, led by CEO Mike Volpe, was in the business of helping make corporate travel less complex. In a short few years, Lola raised millions in investment funds and started making waves in an industry that’s worth more than $1 trillion annually.

Then came COVID, and Lola lost 97% of its revenue and had to lay off 34 employees.

Did Mike throw his hands up and give up? If you know Mike like I know Mike, then you know the answer.

In a move that should inspire all of us, Lola regrouped, pivoted, and set a new course. They knew they couldn’t continue doing what they’d been doing — travel was not coming back anytime soon — but they looked at their talent, skills, staff and realized they could quickly pivot to a different market. A few months into the pandemic, Lola launched Lola Spend, which helps businesses simplify expense management by replacing expense reports with an easy to use app.

It’s not a whole new company — it’s a new direction that capitalizes on the talent and expertise they already had on staff.

Now, nearly a year removed from almost losing everything, the company is thriving again, having expanded its business model and broadened its appeal.

Hire your team and figure out where to go

Lola is just one story, but there are so many others that can provide us with encouragement.

Times of strife can also be times of opportunity, and we should all try to focus on what’s possible.

I know for us at IMPACT, it’s taken a long time to assemble the amazing talent we have on our team. PPP funding allowed us to keep our employees on board so we could keep innovating, growing, and learning. Together.

Even if your business or industry was significantly impacted, and you’re saying to yourself is it even worth bringing people back to my company at this time?, the answer should be yes.

Use this as an opportunity to bring great people into your company, and to get creative. Don’t be afraid to build something new and innovative, just like Lola did.

Think about it this way: Every week that PPP funding can cover your most essential costs is one more week with your team — all while you can bank the other revenue that is coming in.

With a vaccine being rolled out and a likely economic recovery on the horizon, you’ll want to be sure to be staffed up for whatever’s coming.

Free Assessment: